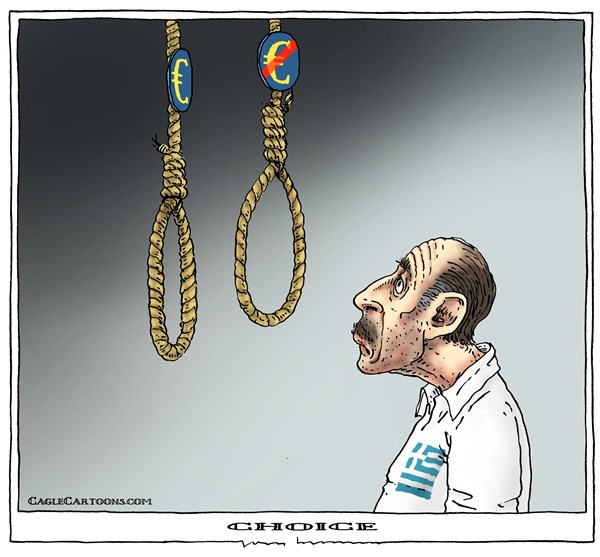

Alas, I couldn't find my favorite cartoon depiction of the upcoming referendum which shows Greece as a diner at a restaurant given a choice between two menu items -- yes and a noose, or no and a pistol. The image was apt -- yes for slow strangulation, no for a sudden, severe, self-inflicted and possibly fatal wound. Not much of a choice! But the cartoon on the left conveys the message pretty well.

In the latest update from Greece two opinion polls are quoted. One poll, conducted June 30-July 1 has the "yes" vote at 41.5%, no at 40.2% and undecided at 10.9%. A small number intend to abstain or leave their ballots blank. Another poll conducted July 1-3 has "yes" at 41.7%, "no" at 41.1%, and undecided at 10.7% Margin for error is 3.1%. So far Nate Silver's statistical blog 538 has not found enough meat here to aggregate polls. So a very slight preference for the noose over the gun, but basically too close to call.

At least my first question has been resolved. The pressure will not be strong enough to force the Grexit ahead of the referendum. But another question remains. Given how close the sides appear to be, it may very well take several days to determine who won. Will events force the Grexit in that time? And what if the vote is yes? The current government will fall. This article points out that it may take several days (at least) to form a new one. And the deal being approved is (theoretically at least) no longer on the table, so even a yes vote may lead to new negotiations and more time for the pressure to build. And (possibly worst of all), the creditors are now divided, with the IMF calling for debt relief and the others refusing, so a deal may not be possible. So events may end up forcing Greece to leave the euro even if the vote is yes.

Like most people, I take for granted that a no vote will mean default and devaluation. The only question is how long it will take.

I also attach the cartoon below. It appears to derive from a 1930's cartoon by David Lowe, which showed the various countries in stormy seas in one boat, with the debtors frantically bailing and the creditors complacently saying, "Good thing it's not in our end of the boat." It has seemed most appropriate in Europe in the current crisis. This is a variant on it.

No comments:

Post a Comment